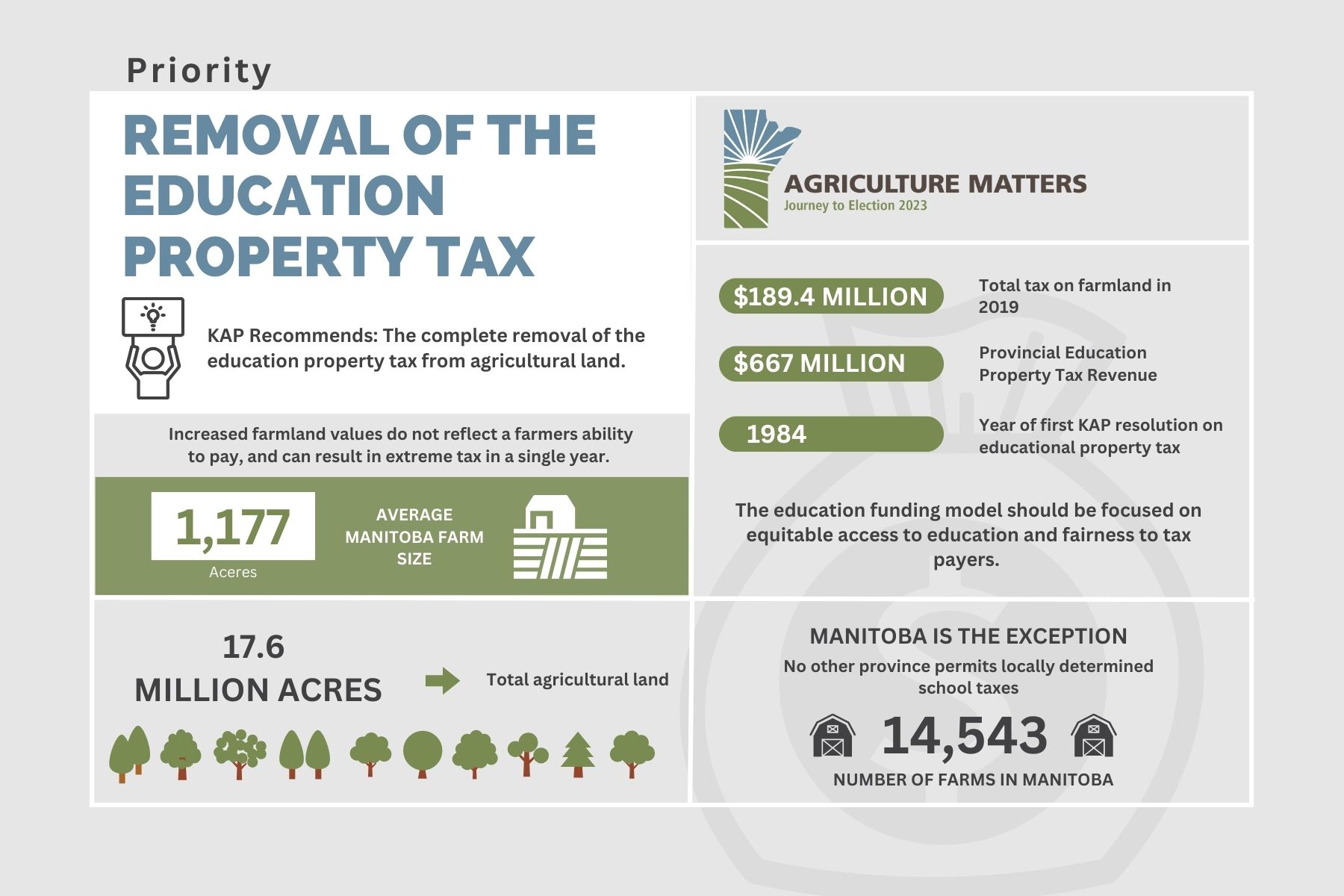

The complete removal of the education property tax from farmland has been a priority issue for KAP since the passage of the first resolution on this issue back in 1984.

KAP believes any education funding model should be focused on key principles of equitable access to education, fairness for ratepayers who support education through taxes, and having stable, predictable funding for long-term success of the education system.

The premise of the education property tax on farmland is rooted in a reality that reflected early 20th century agriculture in Manitoba. In the past century, farms have grown considerably in size while the number of farms has decreased. This has resulted in fewer farmers paying a larger portion of the education property tax.

The current education funding model is outdated since no other Canadian province permits locally determined school taxes; Manitoba is the exception.